If you are looking at buying in the next year or so, then you will absolutely have to have your wits about you.

Firstly, we are still building around 100,000 less new homes in the UK than we did prior the credit crunch in 2007. That’s a loss of approximately 10% of our market. We are also selling around 30% less properties than we have prior to the credit crunch, so less existing properties for sale.

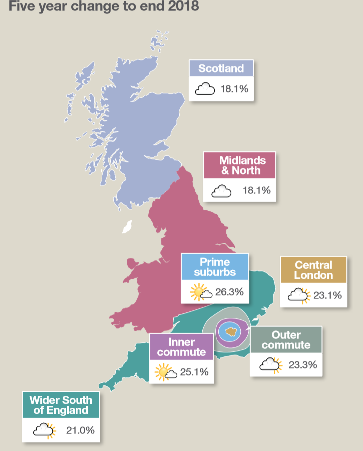

In addition property price are expected to grow as follows according to

Savills five year forecast:-

And finally, with the pick-up in sales over 2013, many services such as surveyors, legal companies and things like securing searches from local authorities are pretty difficult. During the credit crunch so many people lost their jobs, now there are more sales/purchases the industry isn’t geared up to fulfil the demand!

So I’m afraid in reality the chances of you finding the exact property you want, at a price you can afford in the location you want to live, isn’t going to be easy. So if you want to find your ‘dream home’ take your time, don’t pani buy, and consider waiting for a few years instead of rushing in while the market is still so poor.

But, it isn’t all bad news! There are always good reasons to buy a property, but it’s important to make sure you buy because you can afford it, not to overstretch yourself or buy something because you are worried you will ‘miss out’ – that’s partly the cause of the credit crunch in the first place.

Help to Buy for 2014

There is the tremendous support from the government to buy a new home with just 5% deposit through the Help to Buy Scheme. There is a lot of confusion about Help to Buy, but to be clear:-

The benefit of the new build scheme is typically mortgage rates are lower at 3-3.5% (but remember rates are normally 5.5% so make sure you can afford it at this rate). The benefits of buying an existing home is they normally sell for less, but you will be paying a mortgage rate of

5% or more, so higher running costs.

Help to Buy a New Build checklist

Help to Buy an Existing Home Checklist

Easier to renovate

If you do buy a property which you want to do up, the good news is bathrooms, kitchens and lots of other materials are cheaper than normal as DIY and on-line stores compete heavily for lower sales. You are more likely too to find a good tradesperson, but they aren’t always good on doing quotes/admin so you’ll have to persevere with them to get the help you need.

How to Choose a Builder Checklist

How to Avoid a Rogue Trader Checklist

Property prices should grow over the next couple of years

It’s not guaranteed (so don’t buy on this basis), but all the predictions at the moment are property prices will grow – even by just a few percent. This means you end up with an asset which is worth a bit more than you paid for it. And with most mortgages now on repayment, this is good news as you have a chance to buy with a 5% deposit (equity), but increase the equity in your home over the coming years – which hasn’t really been possible since 2007.

For FREE, independent and up to date advice on buying and selling a home, sign up for FREE to Property Checklists. Join now to access our FREE property checklists, including:-