With the government’s squeeze on landlords getting ever tighter, it has become more important than ever to maximise your rental returns.

A third of landlords rely on rental income as an important part of their earnings, according to research quoted in the TDS Report: What levels of return do buy to let investors expect and need their property investment to deliver, when and how?, and you may be one of them. But the pressures of increased taxation could make it a challenge for you to make the numbers add up and you may find you are not seeing the returns you saw in the past – or that you need to make the investment worthwhile.

Read our tips for managing a successful let

You can increase your returns in two main ways: by reducing your outgoings and by boosting your income. And boosting your income isn’t simply a case of putting up your rent, although that is an important aspect of keeping up with inflation.

Here we explain how continuous assessment of your buy-to-let property can help ensure it works for you, now and into the future.

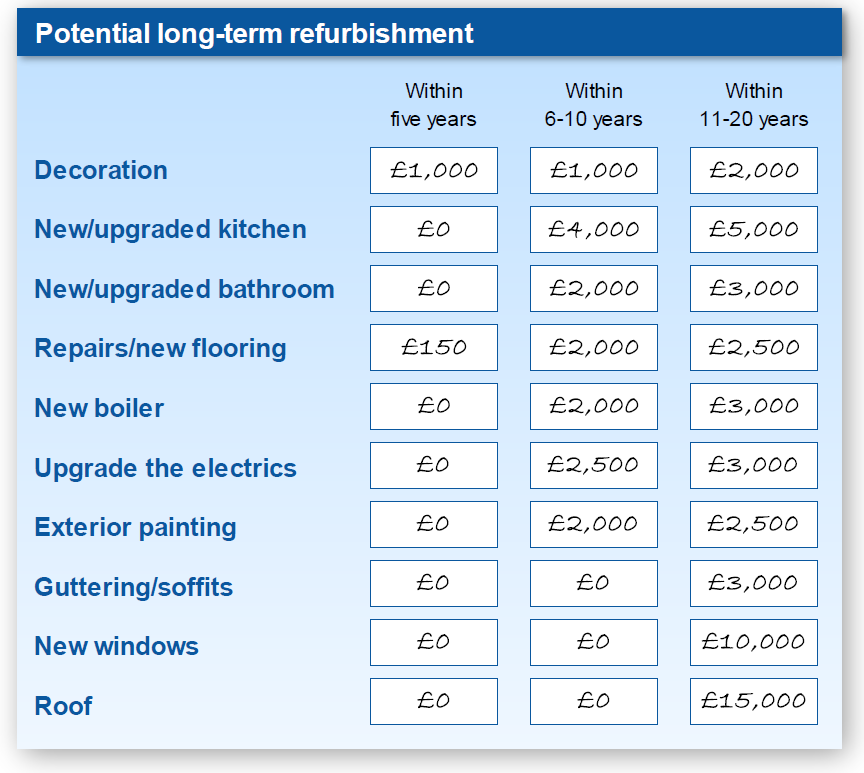

Unexpected repairs can eat into any homeowner’s budget, and make the difference between profit and loss, especially if you need to replace a high-cost item such as a boiler, or an upgrade means your tenants need to move out. You can expect to have to replace the boiler, kitchen, bathroom and to have to upgrade the electrics every 6-10 years, and should factor these costs into your budget accordingly.

You can read more about planning for maintenance and refurbishment in Is Buy to Let a Wise Investment?, the first eBook which accompanies The Buy To Let Show, and in the third eBook, Choosing a Buy to Let.

Read: Five things you are responsible for as a landlord

Void periods are expensive – you still have all the costs, such as mortgage, utility bills and, in some areas, council tax, but receive no income. An empty property could cost you over £300 a month, and if you’re having to spend on repairs and maintenance, too, this will be a further drain on your bank balance, so you will want to keep void periods to a minimum.

There are two things to consider to avoid voids:

The phasing in of Section 24 restricts the amount of income tax relief you can claim on finance costs, such as the interest you pay on your mortgage. In the past, all of this could be offset against your income at your usual tax rate. In the tax year 2018-19, only half of the interest paid can be offset against income and, by the tax year 2020/21, when the changes are fully phased in, none of it will be able to be offset.

For more on Section 24, download The Buy to Let Show eBook 6: Planning an Exit From Buy to Let.

This important change has the potential to nudge some landlords into a higher tax bracket and severely impact their income so it is important to speak to a tax adviser who specialises in buy-to-let, as they will be able to advise you on your particular circumstances. You may find you can mitigate tax by investing via a limited company, although this is not suitable for everyone so you tax adviser can help you make the right decision. You can read some of the pros and cons of investing via a limited company here.

You will find lots of information on tax planning, including a property investment brief, what happens when you meet a financial adviser, and examples of costs and returns of different types of investment in The Buy to Let Show eBook 1: Is Buy to Let a Wise Investment?, while Michael Wright, of RITA4Rent, talks about the need to speak to a specialist tax adviser about your particular circumstances in this clip from The Buy to Let Show.

Read our buy-to-let tax checklist.

Reviewing your mortgage regularly is essential to ensure you are paying the most competitive rates. According to the Money Advice Service, it is a good idea to do this whenever there is an interest rate change, if your current deal comes to an end or once a year if neither of these apply and you are not tied into a deal.

Speaking to your mortgage broker about switching to a better deal can save you money on your monthly mortgage payments, which will all help towards increasing your rental returns. But do make sure your broker has experience in buy-to-let mortgages.

It goes without saying that properties let in the best condition will invite the best rents, so it is important to maintain your property to the highest standards.

So, as well as planning to replace the big ticket items, such as the boiler, kitchen, bathroom and roof, it is vital to stay on top of general wear and tear, both through regular communication with your tenants and via periodic inspections. If your property is managed by a letting agent, they should visit your tenants every 6-12 months to discuss any maintenance niggles they may have not reported; if you are self-managing, don’t skip this important task as it will enable you to resolve any problems and stop something like a dripping gutter from escalating into a costly damp problem. It’s against the law to let a property with mould and damp, so these are definitely problems that need nipping in the bud by an expert as soon as the signs are there.

Everyone wants to feel safe in their home, so security is essential, both inside and out. This means good quality locks on doors and, ideally, windows, as well as an outdoor space which is not easily accessible to intruders. As well as being your responsibility, defined by the Housing Health And Safety Rating System (HHSRS), it will help you to attract higher rent and keep your insurance costs down.

Work out your maintenance budget with our checklist.

Need help maintaining your property or trying to manage from a distance? Find out what a letting agent could do for you.

As well as the important tasks of maintaining the property in good repair to protect both your tenants and your investment, keeping standards at the highest level means you will attract quality tenants who are willing to pay top rents.

These are some of the areas of the property which will need regular attention:

If the property is suitable, and there are no mortgage or leasehold restrictions, you could consider allowing pets, as a quarter of tenants would pay more rent if they could have a cat or dog. You can cover yourself by advertising ‘pets considered’ so you have the option to refuse and cover yourself for potential claw damage by taking a pet deposit and including a pet clause in the tenancy agreement.

Tips on letting to tenants with pets

Even if you are running a successful rental property which is working well, it’s always advisable to stay alert to what’s going on in the local area, as this can help you gauge any potential changes to demand.

For instance, if you own traditional student properties, demand for these could suddenly drop with the arrival of bespoke student apartments offering all mod cons and, in some cases, home cinemas and gyms. Keeping an eye on the Local Plan will enable you to anticipate any developments with the potential to impact your returns.

Assessing demand in your local area can also inform your decision on what to do with the property, such as converting it to a private let for a professional couple or a family. Only by knowing your local area can you make the best decision for your rental returns.

Here’s why you should read your local plan.

Finally, what might seem the most obvious way of boosting your returns to increase your rents. This has to be done carefully, as tenants can only pay what they afford, which is why rents generally increase in line with wages rather than any other factor.

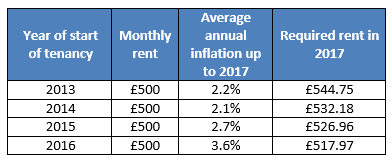

However, it is important to keep your rents in line with inflation, to avoid subsidising your tenants and seeing your income drop in real terms. When you consider that all your other costs – such as insurance, maintenance costs and more – are rising in line with inflation, it makes sense to review a tenant’s rent accordingly every 12 months.

Check out the Bank of England inflation calculator, to see how far your rental income goes,

Using the calculator we can learn how a monthly rent of £500 at the start of a tenancy needs to rise to keep your income levels in line with inflation.

If you include bills in your rent – for example in a student property or other House in Multiple Occupation – your income will have been hit harder, as the six biggest energy supplies increased their bills by between 4.8% and 6.7% between January and August 2018, higher than the Bank of England’s inflation average of 3.6%.

There are steps you can take to make this fair for the tenant, as Belvoir explain in their tips for increasing your rents:

Read more about rental returns on different types of property in TDS Report: What levels of return do buy to let investors expect and need their property investment to deliver, when and how?