There can be few things in life more distressing than having your home taken away from you but sometimes, life can be difficult and throw up particularly challenging circumstances, such as illness, job loss or divorce.

Repossessions are a lot less common than they have been in the past; the most recent credit crunch saw less than half the number of repossession than during the recession of the 1990s.

But still, 1,080 homeowners had their homes repossessed in the third quarter of 2018, according to UK Finance figures. And, while this may be 19% fewer than the same quarter of the previous year, this meant heartbreak and disruption for more than 1,000 families.

Here we offer some tips for avoiding the ordeal of repossession, as well as some advice if it becomes unavoidable or you’re already going through it.

Struggling to make your mortgage payments is something which can happen to anyone and the most proactive step you can take is to contact your lender as soon as you can – ideally before you miss a payment, as going into arrears can limit your options.

With 77,600 homeowners being in arrears of 2.5% or more in the third quarter of 2018, you can guarantee your lender will have experienced this before. They must consider any request to change the way you make your repayments, and respond to any offer you make.

From your perspective, don’t ignore correspondence from your lender and always answer the phone when they call, as this could help you to avoid repossession.

Your lender cannot take action towards repossession your home unless arrears have built up so if you can come to an arrangement, this could allow you to retain your home. Make sure you keep copies of all correspondence, as you may need these as evidence you have taken steps to make payments.

Depending on your lender and the terms of your contract, they may suggest some of the following options:

This may be a possibility if you are able to pay something, but not the whole amount, eg if your household income is reduced due to job changes or a relationship breakdown. This shows commitment so keeps you in the lender’s good books, and you continue to reduce your overall debt.

Work out what you can afford to pay each month before approaching your lender.

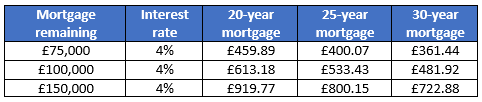

Another option if your income will be reduced indefinitely is to extend the term to reduce your monthly payments. Combining this with other cutbacks could make it feasible to keep the mortgage going.

Example:

Although our Saving for a Deposit calculator is designed for first-time buyers, it can be used by anyone trying to cut back on their expenses.

This may be a temporary option if your lender allows it, as it will reduce your monthly payments. But remember your capital will not be reduced while you are only paying off the interest so it is not ideal, long-term.

Need help finding a better mortgage deal? Read: How to secure the right mortgage.

If your financial difficulties are severe but temporary, you may be able to take a mortgage payment holiday, if this is offered by your lender and you are eligible. Your missed payments are added to the final debt, although interest is still accrued during the break, so the overall payment will be larger, but it could provide the breathing space you need.

If you are struggling to make payments due to job loss or illness, check if you have mortgage protection insurance to cover you for this. If you have had the mortgage for several years, this may be something you have forgotten about.

If you do have a mortgage protection insurance policy and are due a payout, your lender should not start court action.

As well as making cutbacks to your outgoings, there may be ways you can bring in more money to help you with your payments.

If you are already on certain benefits, you may qualify for help through the government’s Support for Mortgage Interest (SMI) scheme, which can help you with a loan to make your mortgage interest payments. Contact the office that pays your benefit to find out if you could get an SMI loan.

This money can be used to pay the interest on your mortgage, but not the capital, so you will either still need to make part of your payments or find out if you can switch to an interest-only mortgage. And, as it is a loan, interest is payable, which will increase the amount you need to pay back, although this can be done when you eventually sell the property.

If you don’t currently receive benefits, your first step is to find out if you are entitled to government help. Check out these benefits calculators which will help you work out what, if anything, you can claim, and how to do so.

If you qualify for pension credit, you may apply for an SMI loan immediately. However, there is a waiting period for other benefits:

Again, talk to the office that pays your benefit to find out more.

There are additional schemes to help you if you live in Scotland or Wales.

By renting out part of your home, you can earn up to £7,500 a year, tax free. If you have a spare bedroom, could you find a lodger? If all your rooms are occupied, could you use the space differently, eg by getting the children to share for a while, or creating a bedroom downstairs? It may be worth the inconvenience as a room rent of £75 per week would boost your income by £300 a month.

You must first check your mortgage agreement; while most do allow you to take in a lodger, some will require you to gain permission first to avoid breaking the terms of your contract. You should also check with your home insurance company and will need to get a valid gas safety certificate, renewed annually.

| How to rent a room checklist |

|

Make sure you choose your lodger carefully, especially if you have children in the house. Sharing your home is a big commitment, so check out our guide for choosing somebody compatible here.

One option could be to move in with family or friends temporarily, or rent a smaller property, and let out your whole home while you get back on your feet.

Key things to consider:

Read our free guide to letting legally and safely and watch The Buy To Let Show, episode 4.

These are just some of the steps you must take to prepare your home to be legally and safely. There are cost implications for most of these, so plan your budget carefully:

Read more about the 29 hazards outlined in government’s housing health and safety rating system (HHSRS).

Once the property is ready to be let, there are further steps to take, both to comply within the law and to protect yourself and your property:

This is by no means a comprehensive list, as there are 400+ rules and regulations related to letting a property. A letting agent can help take much of the stress away. Find out how to choose a good agent here.

If you decide to let your home, here are 12 steps to lettings success.

Could you sell your home and move in with relatives or rent a cheaper property for a while? This could give you chance to get back on an even keel, financially.

If you decide to sell your property, you can ask your lender to delay repossession proceedings. You will need to give them details of any offers you receive and arrange for your solicitor and estate agent to stay in contact with your lender.

There are some tips for selling your home quickly in our guide, What to do if my house isn’t selling. These include:

Talk to local estate agents, as they may have buyers waiting for a property just like yours. Make sure your lender knows your property is on the market.

As well as talking to agents, you can check how your local property market is performing with the help of our checklist and the Advisory’s Propcast tool, and look at sold prices of similar properties in your area, to give you an idea of price. Bear in mind that people generally offer around 95% of the asking price but, if the alternative is repossession, it is worth considering all offers, especially if they come from a cash buyer.

Selling a property at auction gives you certainty and can be quick; exchange takes place on the day, with completion around four weeks later. There will be no lengthy chains and the buyer will pay cash. We have some tips for selling at auction here.

With this method you get a guaranteed sale, for cash, in return for a discount. Not all property buying companies are created equal though, so do ensure they are a member of the Property Ombudsman Scheme and read the checks you should make in our guide to selling to a cash buyer.

| How to sell your home quickly checklist |

|

Again, keep copies of all correspondence in case you need it in the event of your lender applying for a possession order.

If you have explored all your options and still cannot come to an agreement with your lender, they will apply to the court for a possession order.

Losing your home is still not inevitable as you may be able to come to an agreement with your lender.

Here are our tips:

Make sure you take independent legal advice before the court hearing. You may be able to get legal aid, subject to meeting financial criteria. Check if you qualify here.

If you cannot get legal aid, you may still be able to get free advice from a housing or debt adviser, through organisations such as Citizens Advice, National Debtline or StepChange debt charity.

You may also be able to get free, last-minute advice at the court from specialist housing legal advisers.

Gather copies of all correspondence which show you have made every effort to make at least some payments each month.

The court will send you a defence form for you to complete. This is your opportunity to explain why you believe your property should not be repossessed, for example if you were coerced into purchasing the property by a partner. It must be returned within 14 days.

You may still be able to stop the repossession so, as daunting as it may be, do attend the court hearing. This is your opportunity to explain your situation, so take along anything which could help, such as copies of your offers to make reduced payments, or a job offer letter which shows you will soon be back in work.

If you are taking steps to sell the property or take in a lodger, have the offer of a better paid job, are getting help from the council or have made a complaint to the Financial Ombudsman Service, your lender should delay court proceedings.

There are several possible outcomes from the possession hearing, including:

If the court is not satisfied that your lender can prove they have a right to repossess your home, it can dismiss the case. If this happens, you can ask the judge to order the lender to pay their own legal costs, otherwise you will be footing the bill.

There are several reasons why a judge may adjourn the case to a later date, including:

The court may grant your lender a suspended possession order. For example, you may be able to stay in your home, as long as you adhere to the agreement to pay off your arrears, or to give you time to sell the property.

This gives your lender to repossess your home. You will be given a date to leave, usually 28 days after the hearing, although you can ask for an extension if you need longer to find somewhere to stay.

If you fail to leave the property by the date agreed, your lender cannot evict you without a warrant of possession, which gives the court bailiff the power to evict you, usually only one or two weeks after the original date you were given to leave.

Even at this stage, it is still not too late to come to an agreement with your lender, if you have the means to make some mortgage payments. If you are trying to sell the property yourself, you can ask the court to suspend the warrant, so you can stay in it until it is sold. It is a good idea to get advice before requesting a suspension.

If you leave the property, you should take all your belongings with you – the bailiffs cannot remove these. However, if you leave anything behind, the lender has the right to remove it, or demand, via the courts, that you take it away.

Your lender will then sell your property and, while they are obliged to get the best price they can for it, this will usually be at auction for below market value. From the takings, they will keep:

You will receive the remainder, if there is any left over. If there is a shortfall, they will send you a bill for this, and potentially take you to court if you do not pay it. Always take legal advice in this situation.

Voluntary repossession is when you move out, hand the keys over to the lender and stop paying the mortgage. This can be an option if you are in negative equity so are unable to sell the property at a price to satisfy the mortgage lender.

However, there are some major considerations.

Once the lender has possession of the property they will sell it. Note that you will still be liable for any shortfall between the remaining mortgage value and the price they get for the property. For example, if £100,000 is still owed on the mortgage and they can only sell it for £85,000, you will owe the remaining £15,000. You will also remain responsible for mortgage payment and buildings insurance until it is sold, along with any arrears you have already built up.

Something else to consider is that if you ask your local authority to rehouse you after voluntary repossession, they may decide you have made yourself intentionally homeless. If this is the case, they are only obliged to provide you with temporary accommodation, not longer-term housing.