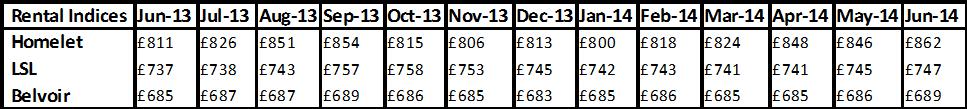

According to the LSL letting agent indices, rents continue to remain fairly steady, together with Belvoir, whose rents have been tracking at around £690 per month for the last year. The Homelet index is an insurance index and shows rental prices were fairly steady from October 2013 through to February 2014, but are now showing much larger increases, currently above inflation. This appears to be due to higher value rental properties, not necessarily increased rents.

The main indices we track monthly are Homelet, LSL and Belvoir. Belvoir and Homelet are national (ie include Northern Ireland, Wales and Scotland), while LSL’s Buy to Let index covers England and Wales.

All three indices do separate out London from the rest of the UK, especially Homelet, which is good, as with any property index, London will make the figures look a lot higher than they would be normally.

Average national rents

According to LSL:_

“The average residential rent across England and Wales is now 1.4% higher than in June 2013. In absolute terms, this amounts to £747 per month, up from £737 per month in June 2013” so not really much of an increase at all.

LSL do explain that “While the latest annual rental increase is below the rate of inflation (CPI of 1.9%) for the thirteenth month in a row, this means rent rises have doubled the pace of average pay growth.”

This has been ‘jumped on’ by some of the media claiming landlords are ‘cashing in’ on tenants. This may make a great headline, but it’s hardly true.

The reality is, rents are rising at less than inflation, so in real terms the landlord is worse off than they were last year. And it also means rents are rising less than other goods and services - so a bit of a harsh criticism. This is especially true when social rents rise annually with an inflation plus model - at least private rents have to take wage changes into account, whereas social landlords don’t.

Download the full report here

Social rents vs private rents

Overall, social rents have gone up by 28% since the recession started, private rents in comparison have increased by 7%.

Even though a 7% rise is higher than wages (on average), the problem isn’t ‘greedy’ landlords it’s about companies not increasing wages. This means it is tough for a landlord to increase their rents and in turn that means it is tough for them to put money aside for repairs and upgrades.

A lack of wage growth is the real problem

It’s about time the headlines started to investigate why companies, when many are making healthy profits, aren’t increasing wages at least in line with inflation.

From an affordability perspective, Homelet suggest tenants should be earning 2.5 times the cost of their rent. And from a general affordability, rents are doing well nationally with the average wage being 2.8 times the cost of the rent. In the main, the most affordable rents are in Wales, Northern Ireland and the North East, each of which suggests tenants earn over 3.5 times their rent.

Download the full report here

The most unaffordable areas are no surprise, London dips below the affordability at 2.23 times rent and the South West just hits 2.55 times. Of course, both of these will be heavily skewed by high rents in some areas.

Overall, rents are pretty affordable across the country, even where prices make it tough for people to buy.