To work out what might happen to property prices in the future and whether now is a good time to buy, sell or invest, understanding what’s happening to demand and supply for property in your local area is essential.

Download the full report for August 2014

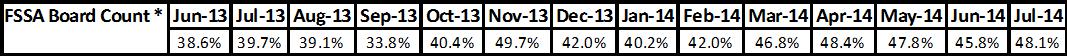

The FSSA* data (see chart above) shows the ratio of properties for sale versus sold fell towards Christmas, but has climbed back rapidly so far this year. Since March, the percentage of properties for sale versus sold has increased, nearly every month reaching 48.1% in July.

Regional contrasts continue throughout the country, with Chessington in Surrey recording the highest ratio of sold vs for sale boards at 73.9%, and Keighley in West Yorkshire recording the lowest ratio of 14.5%. These huge variations continue to underline the need to fully research your local property market and not rely on average figures and headlines to decide whether to buy, sell or invest in property

*For Sale Sign Analysis (FSSA) provides figures which helps us track the number of properties for sale versus sold. This is another good, early indicator of what’s happening locally to supply and demand in the property market.

Download the full report for August 2014

How many viewings do you need to sell a home? How many weeks will it take to sell?

The English market:-

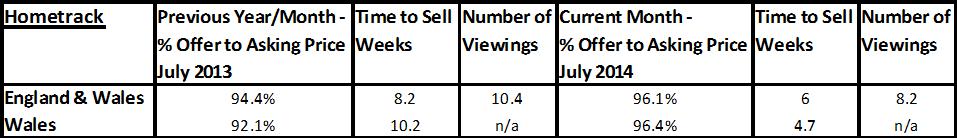

Hometrack’s data for July 2014 versus a year ago, shows key demand and supply indicators have dropped back very slightly, with the exception of the number of viewing required before an offer was received, which reduced from 10 in June to 8.2 in July, which shows the market is good. Although the percentage offer to asking price for England and Wales remains above the magic 95%, which is classed as a ‘normal market’, and the average number of weeks it takes to sell a property in England and Wales has now dropped to six weeks, a fall from just over eight weeks year ago, this is a very slight rise from the previous month.

Download the full report for August 2014

What's happening in Wales?

The time it takes to sell a property in Wales has fallen from just over 10 weeks a year ago to only 4.7 weeks in July 2014. The offer to asking price percentage has increased from just over 92% in July 2013 to 96.4% in July 2014, and remains above the magic 95%, which indicates the Welsh property market has now returned to a much more ‘normal’ market.

There are of course regional differences, and according to Hometrack’s regional data, all areas have continued to see a rise in the average offer to asking price ratio and with the exception of London, a fall in the time it takes to sell a property versus a year ago.

How do the areas of the UK differ?

If you are a buyer, seller or investor, it’s essential you speak to the local agents to find out what’s actually happening in your area, as although regional averages are a guide, there can be vast localised variations in the market.

In London, all indicators point to a property market that continues to be ‘over heated’, with an average offer to asking price of 97.5% during July, and only 4.3 weeks to sell a property. However, this is showing signs of slowing up from June’s figures of 98.7% (the average offer to asking price) and less time to sell a property at 3.8 weeks.

Although the South East region has also been ‘hotting up’ over the last few months, this is now indicating it is slowing up slightly, with an offer to asking price ratio of 97.1% in July, down from 97.7% in June, and now taking four weeks to sell a property, up from 3.5 weeks in June.

The offer to asking price percentages are now above the magic 95% mark in all bar two of the remaining regions, the North East and West, but there still remains variations in the number of weeks it takes to sell a property, from 8.5 weeks in the North East and West to just four in the South East, with the East Midlands almost halving the time it takes to sell a property in July 14 versus July 13.

Download the full report for August 2014

For FREE, independent and up to date advice on Buying, Selling, Buy to Let or Renting a Property, sign up for FREE to Property Checklists. Join now to access our FREE property checklists, including:-