George Osborne’s last budget before the election didn’t have much to say on housing bar more ‘help to buy’ for those that can afford to save.

Help to Buy ISA key information:-

Question and Answers on the Help to Buy ISA

How much help with the government give?

If you save £12,000 then the government will give you £3,000 on completion of your property purchase

When does it start?

The plan is to start the savings schemes in Autumn 2015, but you can start saving now to put up to £1,000 into the plan from the day they open

Will the support on property values be enough?

The average FTB in London spends just under £300,000 and those outside less than £135,000 according to the CML, so the offer of support at this level is very generous and should capture most buyers

What property types can you use the deposit towards?

There is no mention of whether this is restricted to any property type. The information just says ‘bonus is available to first time buyers purchasing UK properties’.

Can you use the deposit together with other government First time buyer schemes?

This could mean first time buyers investing in the new Help to Buy ISA end up getting a ‘double’ bonus where they have help towards savings and then help with a Help to Buy free loan of up to 20% for the first five years of purchase on new builds.

The information from the Treasury says “the scheme can be used in conjunction with any of the other ways the government is helping people achieve their home-owning aspirations, including the other elements of Help to Buy and shared ownership schemes.”

Will this drive up property prices?

Unlikely. This was a massive issue when Help to Buy was announced and it never impacted. To date Help to Buy has supported 80,000 people onto the housing ladder. Out of over a 1 million sales, the amount is too small.

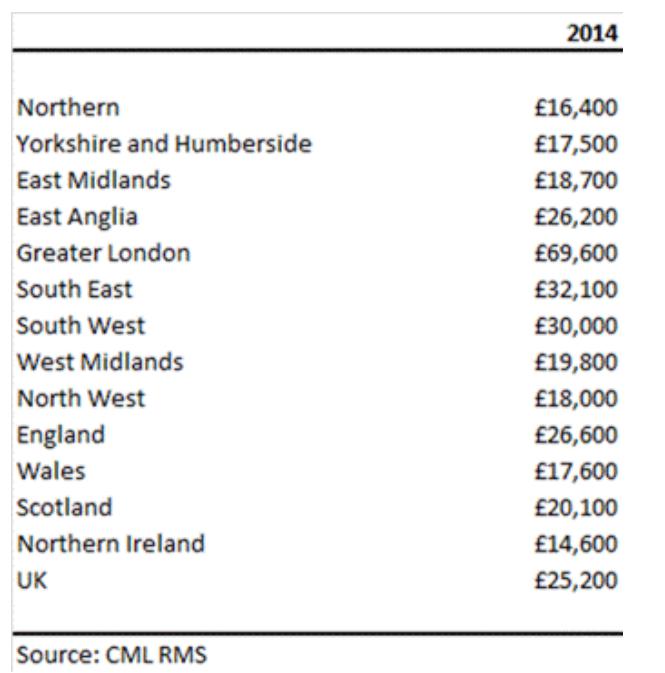

For Londoners, they tend to put down a deposit of around £70,000, so they will be helped up to 10% of their savings and for Northern Ireland deposits tend to be just under £15,000 so they will be helped with up to 25% of their deposit.

The savings plan will take time to kick in though, so as an incentive it is not an ‘instant’ hit on the market.

The table below shows the average (median) level of deposit by first-time buyers across all regions within the UK from the Council of Mortgage Lenders.

How long will it take for people to save now?

The Halifax have done some work on this and estimate “it could reduce the amount of time you have to save by just under a year.” This is based on the first-time buyer house price based on latest Halifax House Price Index.

Background Illustration

|

Average First-Time Buyer Feb 2015 (£) |

|

5% Deposit |

|

Number of Months it would take to save for a 5% deposit (£200) |

|

Number of Months it would take to save for a 5% deposit (£250) |

|

£146, 580 |

|

£7, 329 |

|

37 | 29 |

In their example:-

Is this just another giveaway?

To some extent yes, but it is helping those in the private rented sector without the help of mum and dad to get on the ladder.

Ray Boulger made a good point in that FTBs are effectively getting the money towards their deposit as a ‘tax free sum’ now. That’s exactly the same as someone would who is saving for a pension.

Will it work?

The last Help to Buy initiative effectively turned the market from being in the doldrums to getting back to normal. Although often accused of causing house price rises, it didn’t. London where house price rises were the highest few people bought under the Help to Buy scheme, in fact London was the 5th region in terms of volume of take up on Help to Buy new build.

What may really work is currently many first time buyers aren’t really bothering to save as they don’t believe they can afford to buy – and few are even bothering to check as the media is so full of stories saying ‘it is impossible’ to get on the ladder.

A huge bonus of this could be that savvy first time buyers realise they can save £200 a month which would be £2,400, so for the average of £135,000 purchase, a 5% deposit of £6,750, this would take just under 3 years to save for and then the government would put their 25% extra in – which would either take the deposit up to £8,437 or would mean you would only need to save £5,000 for a deposit.

For a couple, that means saving up to £2,500 each which at £200 a month would mean a 5% deposit in just over a year with the government scheme.

For more information on Help to Buy read: