Rent isn’t the only cost you should be thinking about when you take on a new rental. We explore all the various costs of renting, with insights from room rental experts, SpareRoom.co.uk.

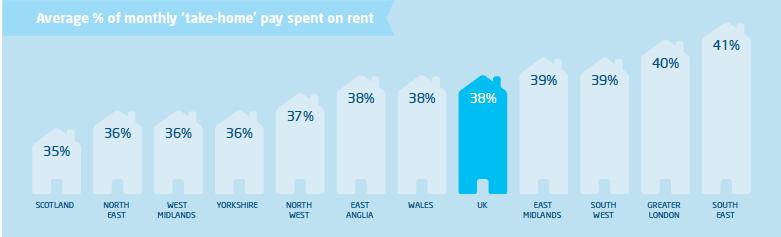

Rent. Obviously, rent is going to be your biggest single outlay, and you should work out how much you can afford to spend to keep a roof over your head, based on your salary. Work out your monthly take home pay (salary after tax) and deduct essentials like food, transport, insurances etc. Normally you should expect to spend 25-30% of your net income on rent. A Rightmove Study from 2012 showed that as rents have risen, so people (often with frozen incomes) are forced to fork out a bigger chunk of their take home pay in rent. In London, 16% of tenants spend more than 60% of their net income on rent.

Read Spareroom's renting a room checklist

Source: Rightmove 2012

You can save on rent in three main ways:

Living in a cheaper area. Flats that are further from the station are also likely to be cheaper.

Choosing a more basic property and cutting back on features like en-suite bathrooms or parking.

Sharing and splitting rent and bills with flatmates – this way you can often live in a nicer place or area than you’d otherwise be able to afford. The more people you share with, the cheaper it tends to be per person, even though you’ll need a bigger property to share between you.

Tip: Rents are advertised as pw (per week) or pcm (per calendar month). Remember that most months are longer than 28 days, so multiplying a weekly rent by 4 won’t give you an accurate figure to budget with.

Utility Bills. These can add a hefty chunk onto your monthly outgoings, and they can be fiendishly hard to budget for – if you receive quarterly bills for gas and electricity, you might not notice that they’re higher in winter, when everyone tends to use more fuel for heating, lighting and cooking. Try to get an idea from previous tenants what they’re paying, and allow for annual rises. According to uSwitch, average gas and electricity bills have gone up nearly £800 in eight years. That's roughly 151% since 2004, easily outstripping any other household essential!

Remember that as well as electricity and gas, you’ll be liable to pay for water, broadband and council tax (unless you live in a house entirely occupied by students).

Tip: Look for room rents advertised as ‘bills inclusive’. This really helps you budget, as you’ll know in advance exactly what your outgoings will be for the duration of your contract, and you won’t have any nasty surprises when a cold snap (inevitably) arrives in winter.

Read Spareroom's renting by the room checklist

SpareRoom allows you to narrow your search to just include rooms advertised as bills inclusive, to help you find rooms that perfectly meet your budget.

Deposit. When renting, the landlord will most likely want some kind of security deposit to guard against damage to the property, and to cover against non-payment of rent. Normally, deposits equate to around a month to six weeks of rent. By law, deposits must be protected if you have a rental contract called an AST. However if you live with your landlord, this doesn’t apply, but you may still need to pay a deposit.

Getting a deposit together as well as having the initial rent money up front can be tough, so you need to be savvy with your money and plan ahead. The good news is that the deposit protection regulation is designed to ensure that landlords can’t deduct sums from your deposit without good reason, and you should get it back in full and on time if you’ve not caused any damage and paid all your rent on time.

Tip: Check what the deposit is before you commit to taking on a rental. In most cases you won’t get your deposit back from a previous rental in time to sign a new contract and put down your next deposit, so you may need to keep extra cash handy for a short time.

Fees. Many agents, and some landlords, charge a fee for taking on new tenants. These can be for a range of services such as drawing up contracts, checking your financial suitability as a tenant and doing inventories. Whilst traditionally fees were only charged to the customers of the agency (the landlords), it’s recently become more and more common to charge some fees to the tenants too. You may even be asked to pay a fee to simply renew a contract. NB fees payable by tenants have been outlawed in Scotland and are now illegal there. However there is an argument that the money is simply being clawed back by charging higher rents.

Tip: It pays to check in advance if any fees are payable, and how much they will be in total, so you can budget for them. Agents charging fees have to make them clear in any advertising (including online ads), right from the start – if they do not do this, you can complain, so do contact the Advertising Standards Authority.

Thinking of renting? Then take a look at Spareroom's:- Rent a room checklist.

Guest article from Sam Cowen

Head of marketing

Spareroom