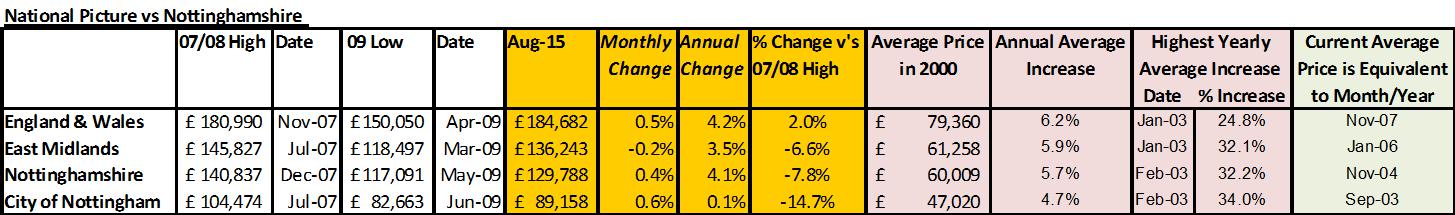

Land Registry sold data – Aug 15

Source: Belvoir

Nottinghamshire areas on the rise

Beeston – some property price growth on individual properties otherwise static

Bingham – doing well seeing some good price growth

Cotgrave – prices on the rise but following quite big falls, so actually static

Hucknall - some property price growth on individual properties otherwise static

Keyworth – doing quite well over last couple of years

Radcliffe on Trent – good growth over last few years

West Bridgford – very good growth, 10-20% over last couple of years

The Park – some of the housing experiencing a little growth, flats flat

Wilford – nice steady growth, helped by tram and new schools etc

New homes

Barratts:

The Wickets – 58 new homes, with a mix of two, three, four and five bedrooms. Located on Belvoir Road, in Bottesford with a new sales centre opening this weekend. There is also a pre-launch event where homebuyers can reserve early on Thursday evening, at The Chequers Inn in Grantham between 5:30pm and 7:30pm.

Sparkenhill Gardens – 74 new homes, with three, four and five bedrooms. Located on Sparkenhill Road in Worksop, one of the town’s most desirable locations.

The first new homes will be launched early in 2016, with show homes opening in the spring

Read: Help to buy a new build checklist

Source: Barratt Homes

How is the buy to let market doing?

Buy to let is seen as ‘all the rage’ at the moment – and to me it’s all for the wrong reasons!

Currently the property market is in a bit of trouble. Namely because there is either so little stock on the market that people don’t want to sell their own as there is nothing to buy, so buyers/sellers end up in a vicious circle. In some areas though there is plenty to sell, but not enough buyers – many are still nervous post the credit crunch/economic crash.

So, property sales and the demand for mortgages are quite low.

The one market where there is interest is buy to let and coupled with being able to take out/reinvest pension pots there is the idea lots of ‘silver landlords’ are likely to come into the market and companies are taking advantage of this, some creating press releases that would try to convince you buy to let is a terrific investment.

And it can be, but you have to know that up until 2004, BTL returns were good in Nottingham (and many other areas) but since then they haven’t been so great at all.

Read: Our BTL property checklists

Here’s an example of the different buy to let returns based on one property in Nottingham:-

Source: Rightmove

If you bought this property in 2002 for £32,000, today it would be worth £81,000, so capital growth of:-

If invested in cash, taking into account inflation, it would need to be worth £46,500 to ‘stand still’

So you could see this has been a good investment, because it iss worth, in real terms, when you take the cost of living into account £34,500 more than you bought for it ie £81,000 - £46,500 (ie the money that your £32,000 would need to be worth now to buy the same amount of goods and services).

If investing in cash, Othe return is £34,500/£32,000 = Over 100%

If you bought with a mortgage, putting down a 25% deposit, returns would be even better:-

However, if you had bought this with cash in 2004 for £73,500, it would need to be worth over £100,000 so in real terms, the investor would have made a loss!

Read: Our BTL property checklists

*These figures/returns are based on a gross capital return which excludes buying/selling costs; tax and maintenance costs, but it also excludes any net income earned from rent.

It is possible to make money from buy to let, but a lot of people have failed in Nottingham. Many of the city centre flats bought by ‘out of towners’ are now half their value.

Failures:-*

Different prices for different properties in the same block:-

Success:-

Source: Rightmove

Advice is:-

Make your money when you buy eg with cash then re-mortgage to hold long term

Ensure you are never ‘forced’ to sell

Buy property which is short supply now and in the future

Don’t do it yourself, use an ARLA/NALS/RICs agent OR be a member of a landlord association

Add in £500-£1000 a year for maintenance ie £15-20k over investment period

Don’t forget to see an independent financial advisor prior to investing so you understand the impact from a tax perspective on your earnings eg what if lose child benefit?

For FREE, independent and up-to-date advice on buying, selling and renting a home, sign up for FREE at Property Checklists. Join now to access our FREE checklists, including:-