2015 has been an odd year for property. The key features are:-

London has continued to outperform forecasted price growth

So far, ‘on average’ property prices in London are still growing in double digits: +10.6% year on year according to the Land Registry. This includes an annual FALL in Hammersmith and Fulham of -0.9% while Hillingdon grew the most by +13.1%.

For more on the latest London price by borough - download our latest London update

Properties for sale have dropped dramatically

According to Robert Gardner, chief economist at the Nationwide, “the number of available homes are reportedly at their lowest level since the late 1970s”

The problem with this lack of choice is it prevents people from moving if they don’t see a property they want to buy. And with housebuilders falling way short of the 250,000-300,000 new-build properties we need per year, an increase in this supply doesn’t seem likely any time soon.

Prices aren’t recovering to pre-credit crunch levels in many areas across the UK

Of the 13 towns and cities we track via the Land Registry data, there are 11 areas which still haven’t recovered to pre-credit crunch levels. With 50% of people owning their homes outright, according to the English Housing Survey, this means many people have lost money on their property in REAL terms, bearing in mind that inflation – ie the cost of living – has increased by nearly 24%.

Some areas, such as Liverpool, are really struggling. Yes, prices may be up by 0.6% year on year, but they are still 27% below the 2007/8 heights and growth is nowhere near the annual average increase of 5% which you’d expect to see by now.

For more on the latest regional prices by area - read our latest summary

Increase in Government market intervention

The last 12 months have seen huge surprises for property professionals; some good, some bad. For example, this time last year, after years of trying, the stamp duty was changed from a ‘slab’ to a more progressive tax which, according to the Halifax, has meant buyers are typically “£4,500 better off”.

At the other end of the scale, from April 2016 buy-to-let investors will be stuck with an enhanced 3% stamp duty, increasing their costs substantially and reducing their capital growth earnings. Income will also be hit from April 2017 when higher rate mortgage tax relief is axed. This is potentially a big problem: existing investors could end up in a negative cash flow situation while, with the fall in yields over the last 10 years, new investors will find themselves unable to do so at a monthly profit.

Read - Why Buy to Let can still work

Meanwhile, thanks to the new Help to Buy ISA, first time buyers will be encouraged to invest: the government will add 25% to their savings, tax-free (a maximum of £3,000 per person/couple) when they buy. This can even be used to help them into shared ownership or another discounted house purchase scheme, such as Help to Buy and the Starter Homes initiative.

Read our - First Time Buyer Checklists

What happens next?

It will be in 2016 that we will actually begin to see what effect, if any, the government’s intervention will have. Policies such as Build to Rent should start adding stock to the market and we will see what happens when the new Right to Buy is offered to the five housing associations testing the idea.

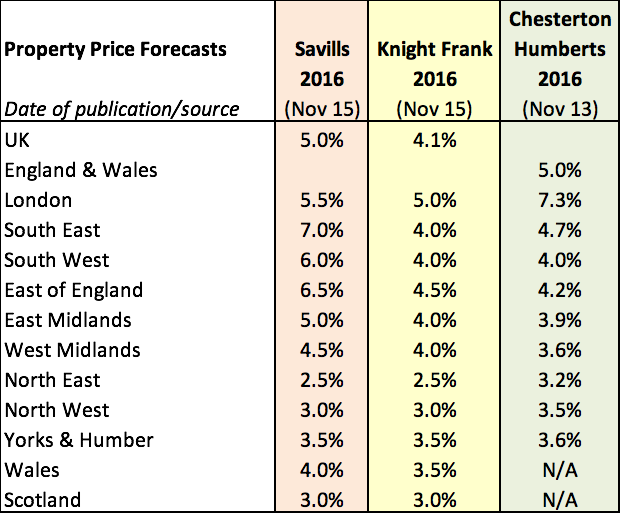

So what do the forecasters think will happen price wise?

Here are the key forecasts for next year:-

What about property’s available for sale?

My concern for 2016 is that stock available, both to rent and buy, will be severely restricted. This will be bad news for buyers and sellers and could end up resulting in the ‘freezing’ of the market. Not only could buyers and sellers struggle to find new homes, but it would also make it very difficult for the industry to continue to grow, perhaps leading to redundancies as the lack of property for sale leads to fewer homes being sold. That means fewer jobs for agents, lenders, legal companies and the removal businesses, plus it could hit the renovation market yet again as buyers tend to spend decent sums of money on their new homes.

In addition, curbing the buy-to-let market will have different results in different areas. In areas like London, it’s likely to have little impact as long as other buyers continue to be able to afford property there. However, problems could be greater in high housing benefit areas, where properties are typically only bought by buy-to-let investors. If they stop buying, and the locals are not in a position to purchase, properties could be left empty, leaving tenants with nowhere to rent either.

This in itself could end up triggering localised price falls, while one or two property-owning investors end up selling out at a knock-down price to bigger professional investors who own property through a company and won’t be hit with the additional tax costs.

What are you planning to do property wise in 2016? How can we help? Any ideas on new products or services we can source for you? We’d be glad to help, always offering independent and free advice and recommending services without receiving a commission payment.

For any advice on property prices please don't hesitate to contact us.

For FREE, independent and up-to-date advice on buying, selling and renting a home, sign up for FREE at Property Checklists. Join now to access our FREE checklists, including:-