The English Housing Survey (EHS) is one of the most interesting and useful reports on our housing stock that exists.

Whether you are a home owner or an investor, or just looking to buy your first property or rent, there are lots of useful pieces of information that can help you understand the market you own, invest or rent in.

I have put together a series of articles that summarise the latest findings for housing in England and explains how our use of property is changing.

If you have any questions, do feel free to contact me.

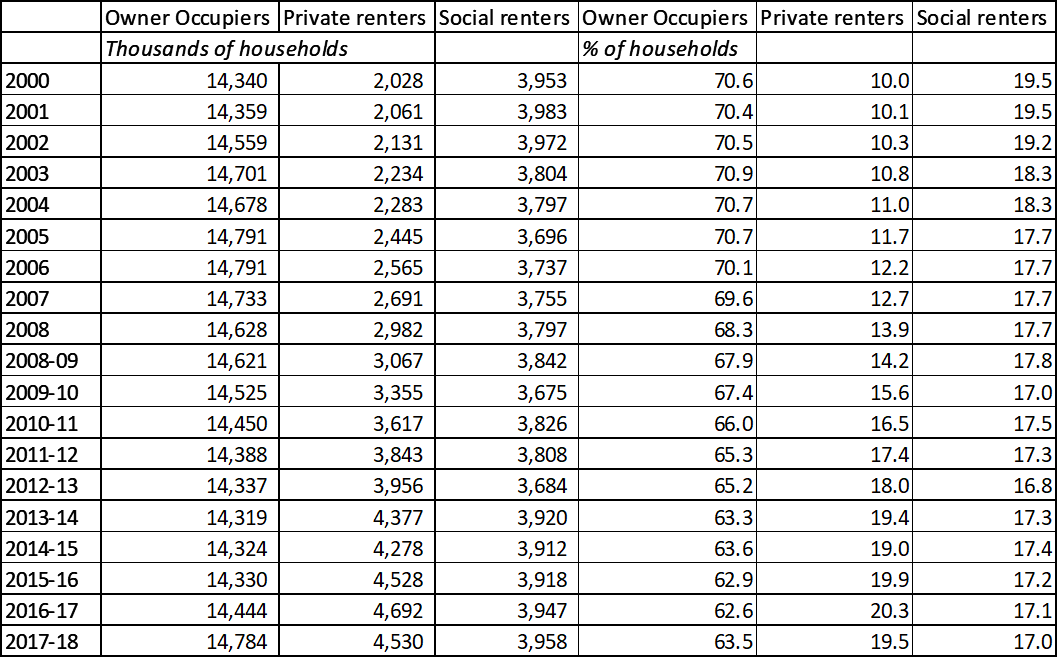

As of 2017-18 there were 23.3 million households in England, an increase from 23.1 million in 2016-17.

In summary:-

64% owned a property with a mortgage or outright, this compares to a high of 71% in 2003.

What’s interesting when you look at this data is although the percentage of people who own a home has fallen, the number of people who actually own a home has risen slightly by 3% from 2000 to 2017/18.

And, although there has been a fall in the proportion of people that live in social housing – from 19.5% in 2000 to 17%, the number of people living in social housing is exactly the same as it was in 2000.

The big change therefore is that the increase in population we’ve seen since 2000 has, in the main, been housed by the private rented sector (PRS).

In 2000, there were just over 2 million people in the sector, today it’s more than doubled to over 4.5 million.

Proportionally though, this is an increase of 10% living in the sector to 19.5%.

Even more interesting is to see when this growth ‘took off’. Many blame ‘buy to let investors’ for stopping people being able to buy a home – always a flawed argument in my view – and I think this is proved by the fact that from 2000 to 2007 (when the recession hit):-

No surprises, since the recovery, more people have come back to purchase property, so it appears the PRS may have ‘topped out’ now at around 19% of the market.

In the last year, thanks to initiatives such as Help to Buy, coupled with the ‘attack’ on the BTL business model, the number of people in the PRS has actually fallen for the first time in nearly 20 years from 4.7 million to nearly 4.5 million – a fall of nearly 200,000 households.

Source: English Housing Survey

Owner occupation comprises two groups, outright owners and mortgagors:-

Since 2013/14 more people have owned property outright than those that have a mortgage. This is ‘good news’ for many as it means whatever happens to property prices, over 50% of people would never be forced to sell due to a rise in mortgage rates. This coupled with new buyers since 2014 being assessed at 6-7%, not 2-3% current rates should mean, if and when there is another economic and house price crash, the property – in theory – shouldn’t take such a big hit.

Famous last words though!

So although it is tougher to secure a deposit to buy a home at today’s prices, with rates being so low and baby boomers paying off their mortgages in droves, if we can find a way to make the deposit element easier, this is the key to helping more people on the ladder.

And of course there is the issue of not building enough homes and making sure the ones we do build are of a good quality!

Read my article: Are developers making large profits from the tax payer?

and Persimmon's build quality criticised by the Government

| Help to Buy a new build - Barratt London |

Storing your belongings - Big Yellow |

The legals of buying & selling a home - The Society of Licensed Conveyancers |

|

|

|